The Perfect Property Portfolio: Why the UK, Dubai & Cyprus could be the ultimate investment combination for the GLOBAL INVESTOR

n today’s global investment landscape, building a resilient, income-generating, and tax-efficient property portfolio is more achievable than ever, especially for internationally minded investors. The right mix of assets across borders can deliver not only strong financial returns, but also lifestyle perks, currency diversification, and future residency or retirement options.Having been an expat for 23 years living in many global locations three markets stand out above the rest for property investment; the UK, Dubai, and Cyprus . Individually, they each offer compelling advantages—but together, they create a synergistic blend of stability, growth, tax efficiency, and flexibility that few other combinations can match.

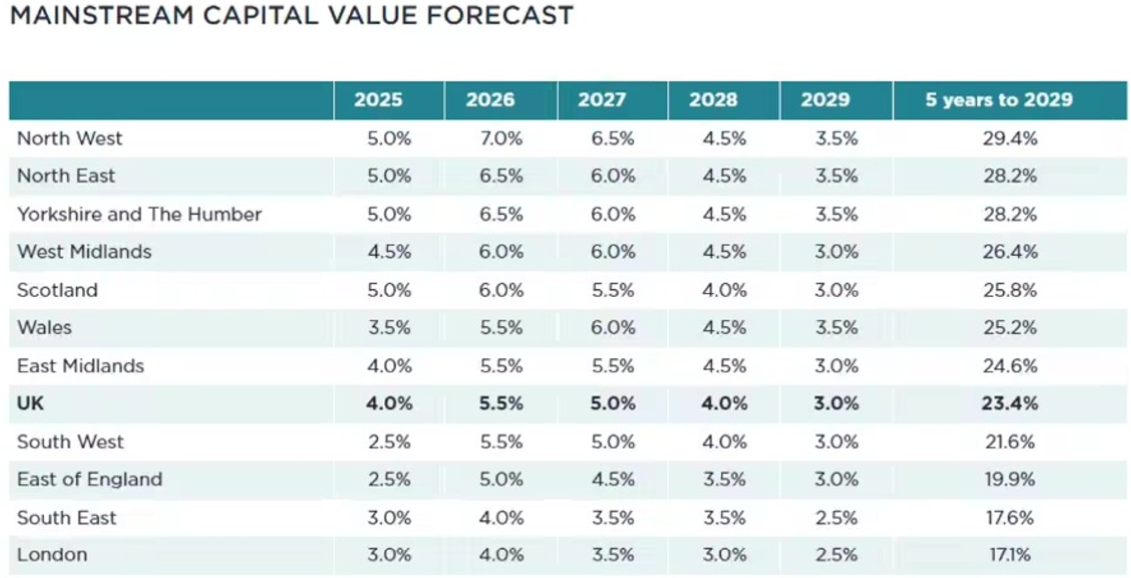

UK – Income stability, steady long-term growth & strong legal framework

The UK remains a global safe haven for property investors. With a robust legal system, high demand for rental accommodation, and an established finance infrastructure, UK property continues to deliver predictable long-term returns (45 positive growth years out of 53) Why it works:

- Stable monthly rental income from professional tenants and families

- Strong capital growth in regional hubs like Manchester, Birmingham, Leeds, and Liverpool

- High occupancy rates driven by undersupply and population growth

- Favourable lending options for overseas investors

Best for: Investors looking for consistent income, certainty in the long-term value, and easy access to capital in a mature, well-regulated market.

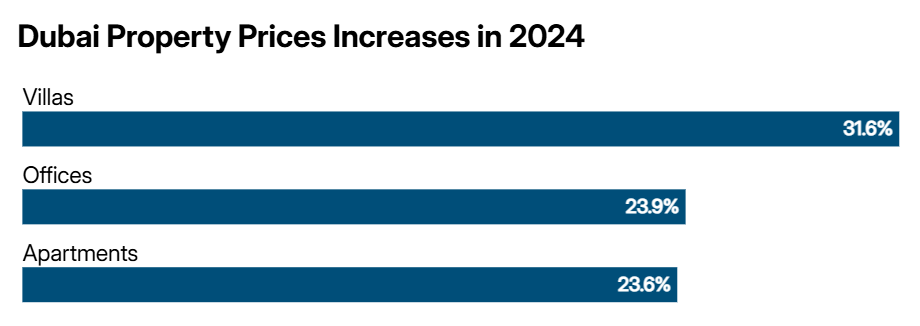

Dubai – High-yield returns, zero taxes & luxury lifestyle appeal

Dubai has evolved into a global property investment hotspot. The city offers exceptional short-term rental yields, a tax-free environment, and a continually expanding infrastructure powered by ambitious vision and government investment.Why it works:

- 6–10% net yields, especially from short-term lets and holiday rentals

- Zero income tax, capital gains tax, or property tax

- Rapidly rising demand driven by global migration, tourism, and digital nomads

- World-class infrastructure and lifestyle appeal: beaches, malls, global events

- Exciting new amenity driven communities and developments

Best for: Higher risk, opportunistic yield-focused investors, expats, and global citizens looking for high returns, tax-free income, and flexible holiday use in a world-class city.

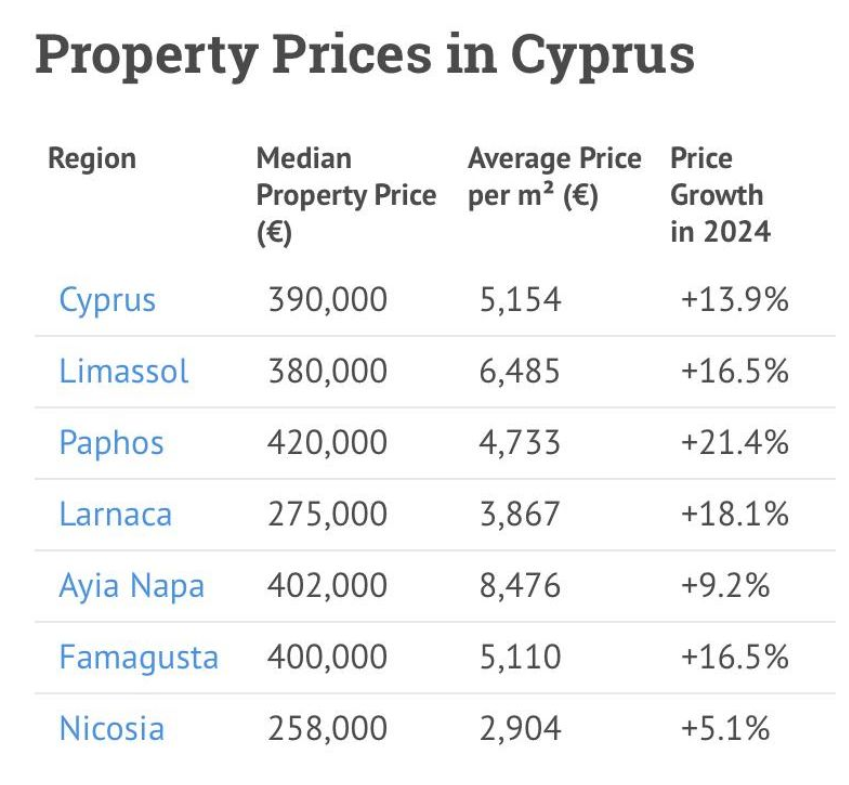

Cyprus – Holiday income, tax perks & EU residency planning

Cyprus is an underrated gem. With 300+ days of sunshine, a strong short-let market, and tax benefits for non-domiciled residents, it offers the perfect mix of lifestyle and financial upside. It’s also an ideal location for those considering European residency or retirement options.Why it works:

- Attractive holiday rental income in destinations like Paphos, Limassol, and Larnaca

- Non-dom tax status: no dividend tax, no inheritance tax, no wealth tax

- Low income tax and mitigated capital gains tax on most real estate transactions

- EU member state = residency options and long-term lifestyle flexibility

Best for: Investors wanting holiday home benefits, European access, and low-tax retirement or wealth planning opportunities.

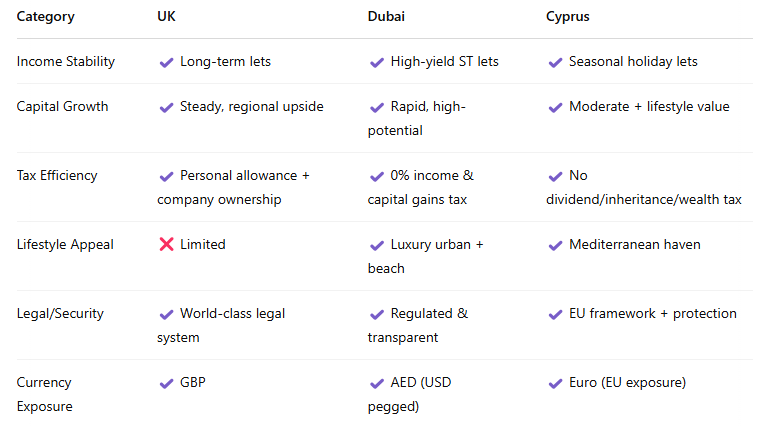

Why These Three Markets Work Together

This trio isn’t just about owning property in different countries—it’s a strategic portfolio that delivers across every key investor priority in currency, usage, location, performance and risk

This multi-country portfolio reduces risk, enhances flexibility, and ensures returns are not tied to a single market or economy. Each asset serves a unique role—income, growth, lifestyle use, or strategic tax planning.

Smart Structuring: Maximise Returns, Minimise Tax

Owning the right properties is only half the battle—how you structure ownership matters just as much. Here’s how investors are approaching each market:

- UK: Potentially use limited companies to benefit from corporation tax rates, and retain profits for reinvestment. Ideal for growing scalable portfolios or planning for intergenerational transfer.

- Dubai: Invest in your own name and enjoy 100% tax-free income. Some use a Dubai holding company for privacy or legacy planning, but for most investors, clean ownership equals clean returns.

- Cyprus: For those spending time on the island, consider non-dom residency status to unlock zero tax on global income, dividends, and inheritance. Property can be held personally or via offshore structures depending on individual goals.

Conclusion: Build the Portfolio of the Future

The UK, Dubai, and Cyprus offer the perfect trifecta for globally minded investors: steady income, exciting growth, powerful tax efficiency, and lifestyle flexibility.Done right, this combination can serve multiple purposes:

- Strong Monthly cash flow

- Capital growth

- Diversified currency exposure

- Holiday use

- Retirement planning

- Tax mitigation

- Wealth preservation across generations

Whether you’re starting with your first international investment or scaling a mature portfolio, this trio offers the perfect foundation for long-term success.

Interested in building your own UK-Dubai-Cyprus portfolio? Get in touch and let’s tailor a strategy around your financial goals, lifestyle plans, and exit horizons.